ADVERTISEMENT

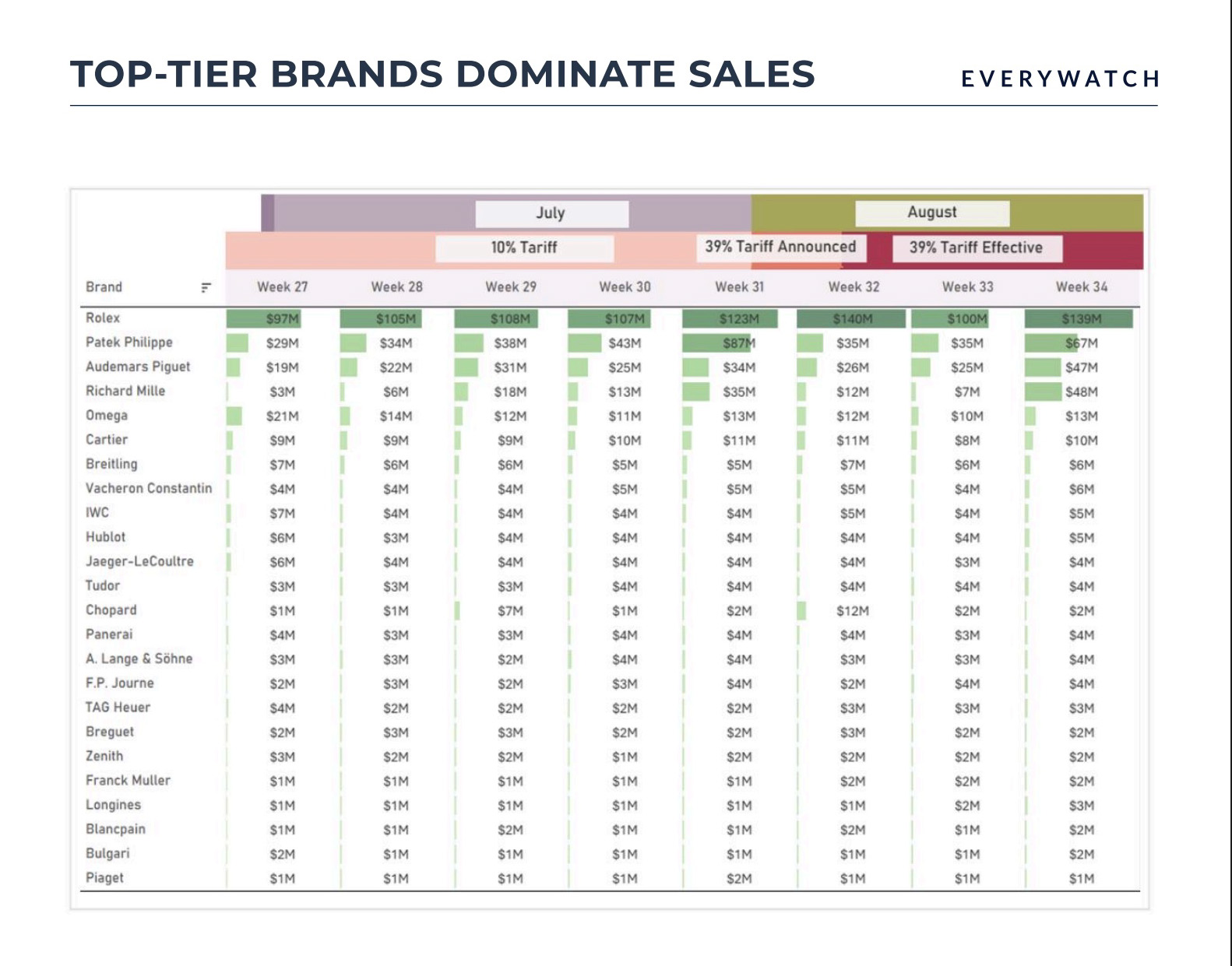

Prices and listings for pre-owned watches from top-tier brands, including Patek Philippe, Audemars Piguet, and Rolex, increased after the U.S. announced significant tariffs on Swiss imports in August. But the rise was short-lived, according to data compiled by Everywatch, as buyers pushed back and the secondary market stabilized after the larger-than-expected duties were implemented.

Global sales of pre-owned Patek Philippe watches by used watch dealers more than doubled to $87 million during the week the tariffs were announced, from $43 million in the previous seven-day period, Everywatch data shows. Secondhand Rolex sales also jumped to $123 million during the same week from $107 million the week before. In the next week measured, Aug. 4-10, during which the tariffs came into effect on Aug. 7, sales of used Rolex watches at secondary market dealers increased 14% to $140 million, the Everywatch data shows.

Source: Everywatch

Sales increases during the period were most concentrated among top-tier, higher-priced brands, with Audemars Piguet, Richard Mille, and Chopard pre-owned watch sales also climbing higher. In contrast, sales of brands with mid-tier prices on the secondary market, such as Cartier, were less volatile during the period of the tariffs being announced and in the weeks following their implementation.

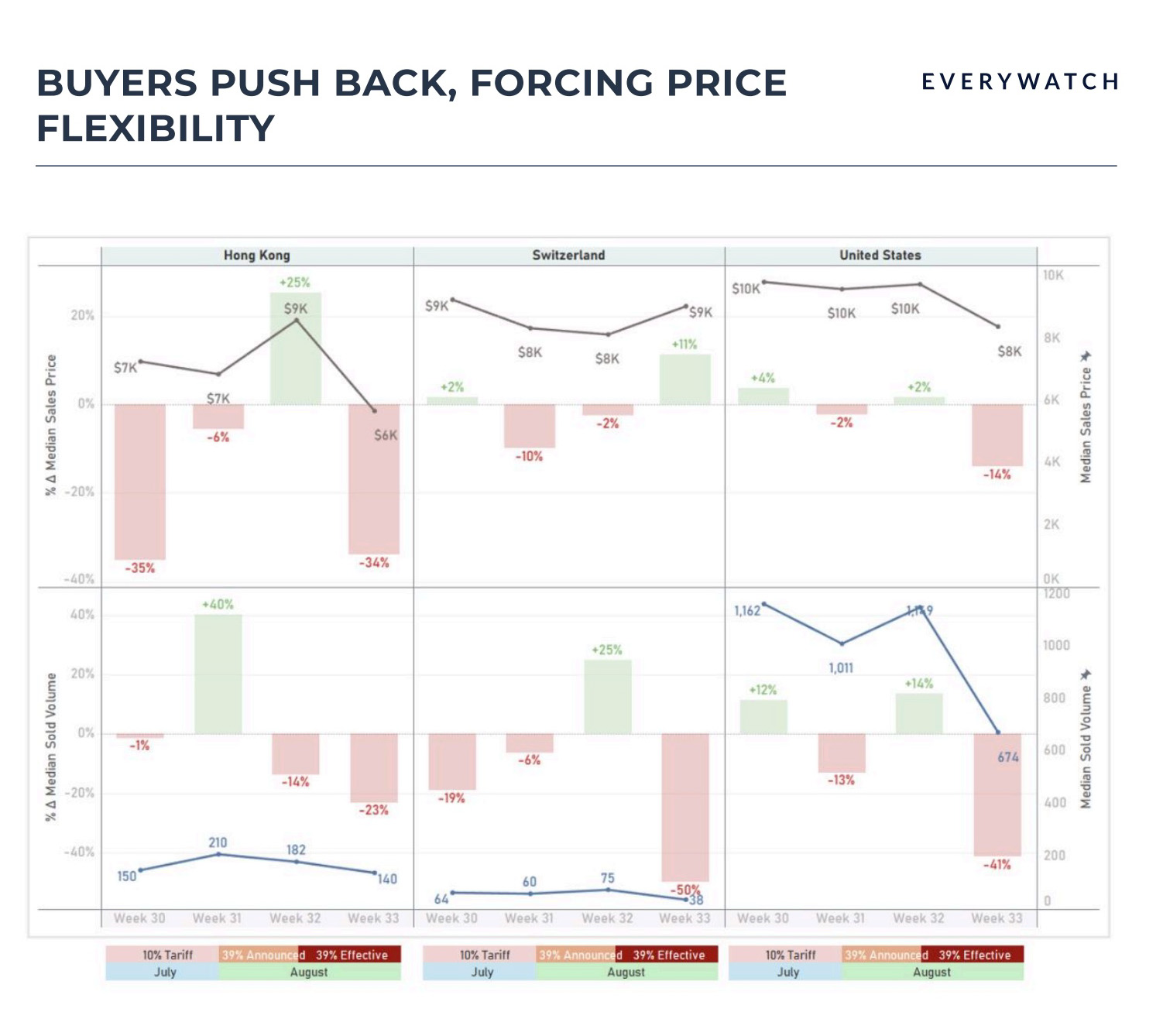

After an initial period of gains in volumes and average prices listed during the tariff announcement and implementation period, the Everywatch data shows that weekly overall sales volumes and average sales prices fell sharply at the end of August, particularly in the U.S. and Hong Kong. According to Everywatch, U.S. sales of pre-owned watches declined 41% by volume and 14% in average price during the last week of the month from the previous week.

Source: Everywatch

The data, which Everywatch compiles and digitally processes from publicly available listing and sales information on the internet, represents an early indication as to how buyers and sellers of pre-owned watches responded to the disruption of 39% tariffs on Swiss goods imported to the U.S. market. It shows that the tariffs sparked a surge in activity in secondary watch market pricing and listing, with some top brands, including Patek, seeing a jump in sales. That was soon followed by a correction as buyers pushed back against higher prices and sellers withdrew or slowed new listings, particularly in the U.S. However, global pre-owned sales of many of the most expensive brands, including Audemars Piguet, Patek, Rolex, and Richard Mille, remained relatively strong following the U.S. market volume and average price pullback. Some of the top Swiss marques are increasing prices for new watches in response to U.S. tariffs, with brands including Blancpain, Patek Philippe, Jaeger-LeCoultre, and Cartier raising or planning to raise U.S. prices to offset the financial impact.

Swiss watch exports fell in August, declining by 16.5% from a year ago, as shipments to all major markets, particularly the U.S. and mainland China, dropped sharply, according to the Federation of the Swiss Watch Industry. Exports to the U.S. surged in April and July this year as brands rushed to supply retailers before tariffs were implemented. In August, however, exports of Swiss watches to the U.S. skidded 24% lower from a year ago, while shipments to mainland China dropped almost 36%. In the first eight months of the year, overall Swiss watch exports have declined by about 1% to CHF 17 million, compared to the previous year, the Federation says.

Top Discussions

IntroducingDoxa Sub 300 Carbon Seafoam Limited Edition

IntroducingBaltic's Dive Watch Gets A Facelift With The Aquascaphe MK2

Hands-OnThe Timex Marlin Quartz GMT